6 4 Cost Behavior Financial and Managerial Accounting

We see that total fixed costs remain unchanged, but the average fixed cost per unit goes up and down with the number of boats produced. As more units are produced, the fixed costs are spread out over more units, making the fixed cost per unit fall. Likewise, as fewer boats are manufactured, the average fixed costs per unit rises. Distinguishing between fixed and variable costs is critical because the total cost is the sum of all fixed costs (the total fixed costs) and all variable costs (the total variable costs). We are really well exposed to the concept of variable costs that change in the same proportion as the activity level increases. For example, if the activity level increases by 20%, the variable cost increases by 20%.

- Many prisons and jails analyze step costs based on annual prisoner cohort numbers.

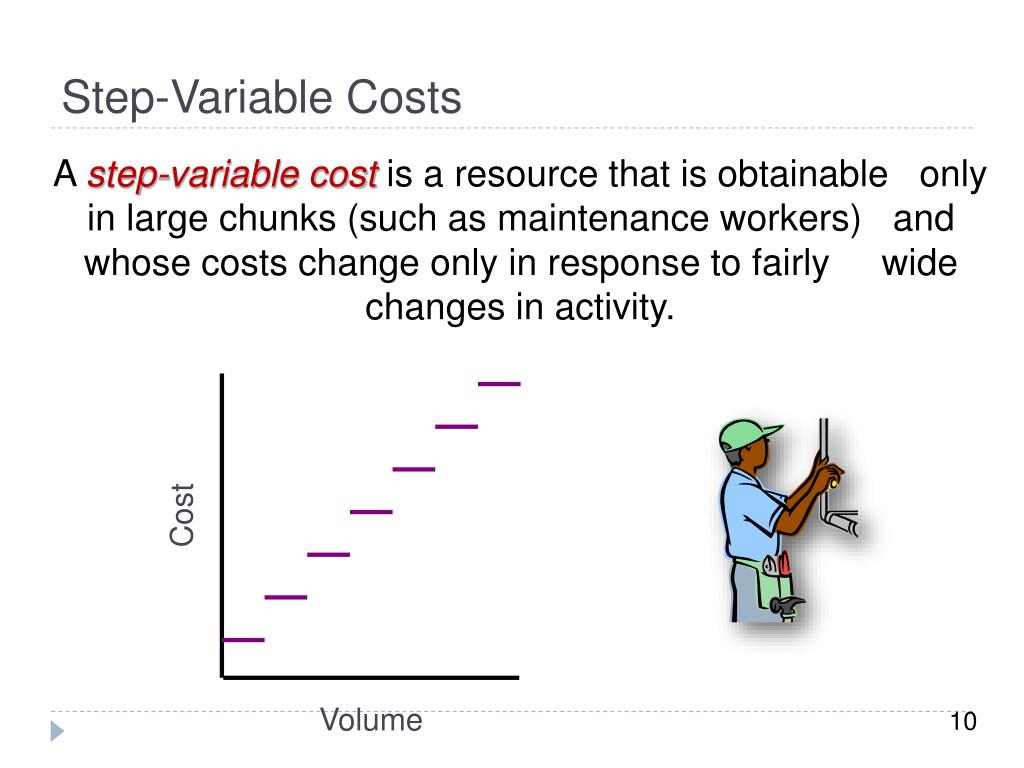

- As supply and demand changes, a flight of stairs is a good visual representation of step variable cost.

- Both of these costs could potentially be postponed temporarily, but the company would probably incur negative effects if the costs were permanently eliminated.

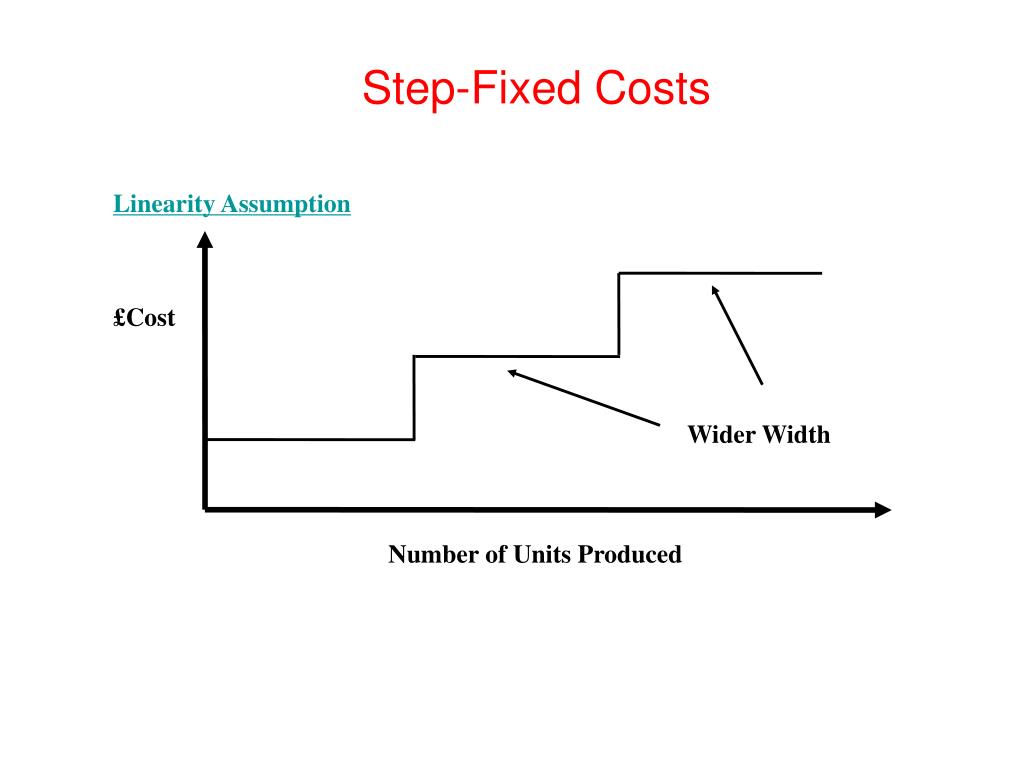

- This concept is crucial for budgeting, pricing, and decision-making, as it highlights the impact of reaching certain production or activity levels on overall costs.

- To that end, it requires to deploy additional machinery, personnel and plant as an additional cost per year.

Examples

The revenue generated from only 50 additional units from that machine, however, is only $1,000. Exceeding the threshold (1,000 units) in this case, the step cost ($5,000) would be higher than the revenue generated ($1,000), causing the company to lose profits. With pricing for accounting software Quickbooks, for example, your costs can increase or decrease based on the number of user accounts needed. For the Essentials Plan of $30 per month, you can create up to three user accounts. The $30 cost remains constant whether you create just one user account or three.

What does stepped cost mean?

Other examples of step costs for companies include salaries and benefits, which remain a constant cost until a single sharp increase. As supply and demand changes, a flight of stairs is a good visual representation of step variable cost. As per the applicable threshold, the step cost for 18,000 units is $20,000 since the activity level lies in the last threshold of 15,001-20,000 units. However, how much does turbotax cost prices this cost can be converted to a true variable cost by paying employees a fixed amount for each pencil they make, instead of a fixed wage. For example, if the employee is paid 10 cents for each pencil he or she makes, the labor cost is now a true variable cost. The Ocean Breeze is located in a resort area where the county assesses an occupancy tax that has both a fixed and a variable component.

Step Costs: Definition, Significance, and Examples

Many costs do not vary in a strictly linearrelationship with volume. The point at which a step cost will be incurred can be delayed by implementing production efficiencies, which increase the number of units that can be produced with the existing production configuration. Another option is to offer overtime to employees, so that the company can produce more units without hiring additional full-time staff. Step costs are expenses that remain constant for a range of workload.

Strategic Cost Management

Understanding these cost behaviors is crucial for the catering business owner when pricing their services, negotiating with clients, or determining profitability for different event sizes. Conversely, a truly variable cost will vary continually and directly in concert with the level of activity. This example mentions the cost relating to various activity levels (i.e., units produced). Suppose the company is operating at a production capacity of 18,000 units.

Spring Break Trip Planning

The third major classification of product costs for a manufacturing business is overhead. These overhead costs are not directly attributable to a specific unit of production, but they are incurred to support the production of goods. Some of the items included in manufacturing overhead include supervisor salaries, depreciation on the factory, maintenance, insurance, and utilities. It is important to note that manufacturing overhead does not include any of the selling or administrative functions of a business. It requires the application of labor to the raw materials and component parts.

Fixed costs remain constant (in total) over somerelevant range of output. Depreciation, insurance, property taxes,and administrative salaries are examples of fixed costs. Recallthat so-called fixed costs are fixed in the short run but notnecessarily in the long run. These expenses are fixed for a certain range of activity, but will increase or decrease beyond a certain threshold level. Step cost (or stepped cost) reflects the behavior of the total cost of an operation/ activity at various levels. Given the importance of step costs to the profitability of a business, it makes sense to clearly identify the activity levels at which these costs will be incurred.

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. The owner eventually decides to hire a second cashier due to the shop’s additional customer flow. Although business hasn’t doubled, the bakery shop now has two cashiers. A bakery shop can serve up to 20 customers per hour with one cashier.

Leave a Reply