Labor Rate What it is and how to calculate it

If you’re wondering how labor costs affect your company, keep in mind that labor cost isn’t just about the hourly rate you pay your employee. Labor costs include many other expenses that your company covers. Just divide your total labor sales by the number of hours sold or billed during a specific time period. Your business made $10,000 in labor sales and worked 500 billable hours last month.

Labor cost calculators save you time

Likewise, in the case of shifts, your employees’ hourly rates may vary according to the type of shifts they work. This means that 20% of your total expenses are entirely allocated to labor cost. Labor cost analysis shows its significance in several areas of a business. Let’s analyze some of them to better understand why calculating labor cost is so important for any company.

Factors that influence labor cost

She is an hourly, non-exempt employee, who works full-time in a company in California with more than 26 employees. Our labor cost spreadsheet provides a ton of benefits for your business. Even if you’re an Excel guru, adding in custom formulas can take forever. With our template, you can spend that time focused on something else. We’ve done all the work for you so you can get a functional template in seconds, not hours.

What are the different types of labor costs?

Stated again for clarity, this expense refers to salaries, wages, and benefits paid to workers directly involved in performing a service or manufacturing a product. Direct labor cost even includes monies paid to individuals for ancillary tasks not related to the “hands-on” manufacture of a product or the “face-to-face” provision of a service. Direct labor cost is one of the key components of fundamental business benchmarks such as efficiency and profitability. It’s no wonder, then, that understanding and calculating this financial variable is a big part of whether or not your business runs smoothly.

Where can I find more information on calculating employee labor costs?

- When a labor rate is to be used as the billing rate for an employee to a customer, a number of considerations must go into its calculation.

- Regardless of the cause, a high labor turnover rate can be costly for a company.

- The amount of bonus is generally a percentage of the wages earned.

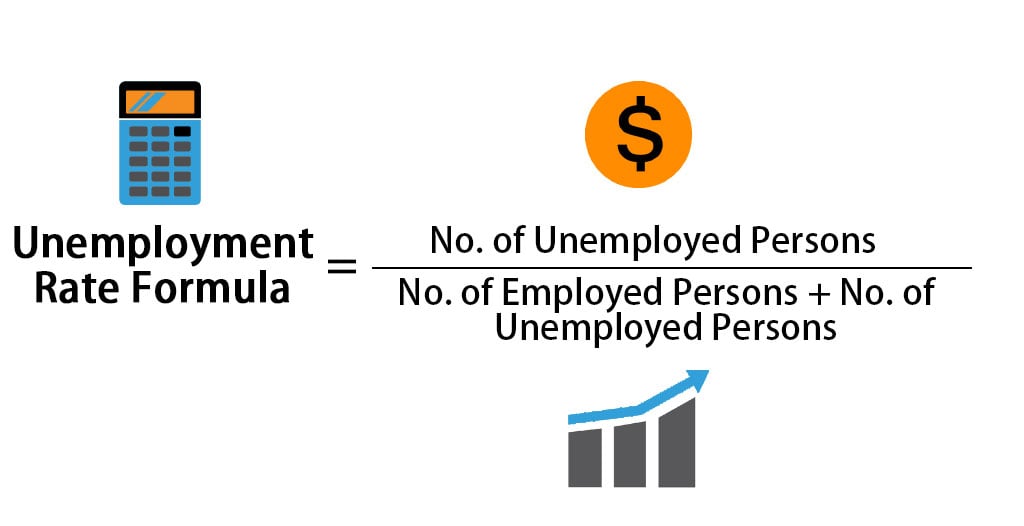

- Find the direct labor rate variance of Bright Company for the month of June.

- Now, divide $39,200 by the number of hours the employee will actually work in a year (about 1,960) to calculate the true hourly rate of that employee.

In this example, the Hitech company has an unfavorable labor rate variance of $90 because it has paid a higher hourly rate ($7.95) than the standard hourly rate ($7.80). The other two variances that are generally computed for direct labor cost are the direct labor efficiency variance and direct labor yield variance. In essence, then, this number is your annual best expense tracker apps of 2021 direct labor cost — it’s how much you’re actually paying out for your employee to produce widgets every year. To calculate the percentage of operating costs that go toward labor, divide the total labor cost by operating costs. Salaried employee costs are easy to calculate since they have a fixed annual salary and aren’t typically eligible for overtime pay.

How can I reduce labor costs?

The amount of bonus is generally a percentage of the wages earned. Instead of penalizing the worker, a lower differential price rate is paid for work done below the standard time. It is a wage payment in which a worker gets a high piece rate for completing the job within the allotted time and a lower piece rate for completing the job beyond the allotted time. Labor productivity measures how much output (in terms of goods or services) is produced by one unit of labor input.

They’re also your starting point when calculating related expenses like payroll taxes, which we’ve broken down in more detail below. For a better insight into how much an employee costs, you can also check the labor cost percentage, which is the relationship between your labor cost and your total revenue over a period. Just apply the following labor cost percentage formula to get the answer. To calculate labor cost percentage, first determine your annual gross revenue. You can find this info at the top of your company’s income statement.

Understanding the difference between your company’s direct and indirect labor costs is crucial for pricing, as you get a fuller picture of profit margin per product. That’s why it’s essential to understand what labor costs are and how they are determined. Labor cost does not only mean the hourly rate that you pay a member of your staff. It spans a number of other expenses that you need to account for. Only after factoring them in you can get the actual labor expenses for your company.

Depending on the level of specialization your employees have, the labor cost percentage can be lower or higher. Comparing labor costs against key performance indicators helps in assessing your workforce’s productivity and efficiency. It enables businesses to identify high-performing employees or teams and address areas that need improvement. Labor cost analysis plays a crucial role in determining the pricing of goods or services. By accurately calculating labor costs your businesses can set competitive prices, ensuring profitability.

For example, between payroll taxes, training, and paid time off, let’s assume an additional annual cost of $6,000. Whatever the setting is, tracking and managing direct labor costs and rates can help management optimize the production process, keep costs low, and improve efficiency. Direct labor can be analyzed as a variance over time, across products, and in relation to other process, equipment, or operational changes.

Leave a Reply